Your Bridge to Talent: Temporary FP&A and Accounting Staffing Solutions and Permanent Placement Expertise Combined.

Our approach

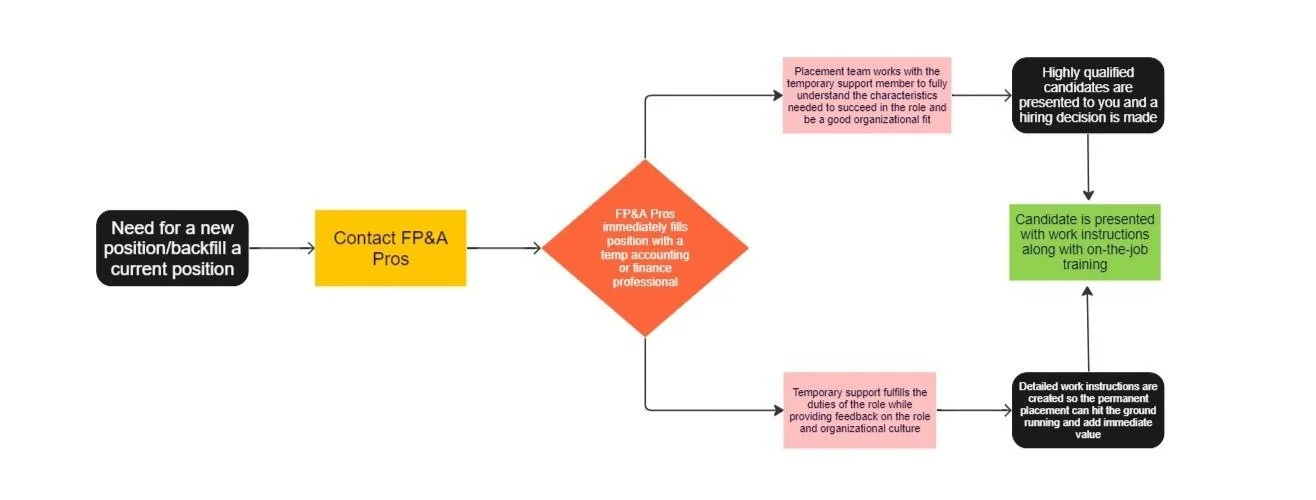

We believe that FP&A and accounting are essential functions in any business. Our aim is to offer high quality temp staffing for your accounting and FP&A teams while looking for a permanent placement that is a perfect fit for your organization. Whether you’re looking to backfill an employee departure or are looking to grow your team with a new role, FP&A Pros can provide your accounting and finance teams with the support needed to function at a high level. Under-resourced accounting and FP&A departments can lead to low employee morale, poor departmental performance, and be detrimental to organizational operations. Our experts at FP&A Pros can immediately fill vacant accounting and FP&A roles which ensures business continuity and prevents bottlenecks with the finance and accounting departments. As we familiarize ourselves with the role and organization we will be able to gather a crystal clear picture of what a great permanent placement looks like, as well as understanding the duties and intricacies of the role to enable us to provide your new candidate with the resources they’ll need to succeed.

Supported Business Functions

In addition to supporting your current finance and accounting functions the experts at FP&A Pros can also help you develop and expand upon those functions. Take a deeper look at our supported business functions to see how we can help take your accounting and finance functions to the next level.

Modeling

Financial modeling involves the creation and analysis of mathematical representations of a company's financial situation. It utilizes various techniques and tools to forecast future financial performance, evaluate investment opportunities, simulate scenarios, and aid in decision-making, enabling businesses to make informed choices based on quantitative insights and projections.

Accounting

Accounting is the systematic process of recording, summarizing, and analyzing financial transactions and information within an organization. It involves maintaining accurate financial records, preparing financial statements, and ensuring compliance with accounting principles and regulations, providing essential insights into the financial health and performance of a business.

Financial Reporting

Financial reporting involves the preparation and presentation of financial information to stakeholders, such as investors, creditors, and regulatory authorities. It provides a comprehensive view of a company's financial performance, including income statements, balance sheets, and cash flow statements, enabling stakeholders to assess the financial position, make informed decisions, and evaluate the overall health and viability of the business.

Budgeting & Forecasting

Budgeting and forecasting are essential financial management processes that involve planning and projecting future financial outcomes. Budgeting focuses on setting financial targets and allocating resources, while forecasting involves predicting future financial performance based on historical data and market trends. Together, these processes provide organizations with valuable insights for financial planning, decision-making, and resource optimization, helping them achieve their goals and navigate potential challenges.

Sales Operations

Sales operations support involves providing critical assistance and resources to sales teams to optimize their effectiveness and efficiency. This includes managing sales processes, implementing sales tools and technologies, analyzing sales data, modeling and administering variable compensation plans, and providing insights to enhance sales performance and achieve revenue targets, ultimately enabling the sales team to focus on driving sales and maximizing customer relationships.

KPI Reporting

KPI (Key Performance Indicator) reporting involves tracking and analyzing specific metrics that reflect the performance and progress of an organization towards its goals. It provides valuable insights into critical areas such as sales, revenue, customer satisfaction, and operational efficiency, allowing management to make data-driven decisions, identify trends, and take corrective actions to drive business success.

The roles we are able to support in temporary and permanent placement span across almost every role within a typical accounting or finance department. From entry level to advanced managerial talent FP&A Pros has you covered.

Supported Roles

Staff Accountant

A staff accountant plays a crucial role in maintaining accurate financial records and assisting with various financial tasks within an organization. Their duties typically include preparing financial statements, reconciling accounts, processing transactions, assisting with budgeting and forecasting, and ensuring compliance with accounting standards and regulations.

Accounting Manager/Controller

A controller or accounting manager oversees the financial operations of a company, ensuring accuracy, compliance, and efficiency. Their duties include managing financial reporting, supervising accounting staff, developing and implementing internal controls, overseeing budgeting and forecasting, and providing strategic financial guidance to support business decisions.

FP&A Manager

An FP&A (Financial Planning and Analysis) manager is responsible for leading the financial planning, budgeting, and forecasting processes within an organization. Their duties include analyzing financial data, preparing financial reports, providing strategic insights, supporting decision-making, and collaborating with various departments to align financial goals with overall business objectives.

Bookkeeper/Accounting Clerk

A bookkeeper or accounting clerk is responsible for maintaining accurate financial records, including recording financial transactions, reconciling accounts, and processing invoices and payments. They assist in preparing financial statements, managing accounts payable and receivable, and ensuring compliance with relevant accounting principles and regulations, playing a critical role in maintaining the financial health and integrity of the organization.

Financial Analyst

A financial analyst is responsible for analyzing financial data, conducting market research, and providing insights to support investment decisions and strategic planning. They assess the performance of investments, create financial models, perform risk assessments, and generate reports that aid in forecasting, budgeting, and optimizing financial resources for the organization.